The Case for Catchers – Stars or Scrubs?

You should either buy an upper-tiered backstop, or you should stream catchers.

I will make the above case by analyzing what would have happened over the past couple of seasons in two-catcher formats. We will take a look at the hit & bust rates by catcher price point. We will also as examine the profitability / return on investment of each backstop tier.

Last month, my colleague, Jeff Zimmerman wrote about the volatility of catchers. He concluded that catchers are a relatively safe fantasy baseball position to invest in. Today, I will go a bit further and break down the various parts of the catcher curve. We will explore the segments contributing to wiser investments, and the parts where you ought to stay away from, if possible.

Let’s begin …

Definitions and Data Used

Very generally, any return on investment study requires two basic ingredients:

- The cost of purchasing the investment at time t=n, and

- The value of the investment at time t=n+1

To help us study the profitability of various stretches upon the catcher curve, I have assembled both pre-season and post-season data from the past two seasons (2018-2019). The pre-season data will consist of what was paid for a player – i.e. the cost of the investment. The post-season data will be what the player had earned over the course of the season. 2018 pre-season data will be compared to 2018 post-season data, and likewise for 2019.

A few definitions to help us:

- Annual Auction Value (AAV)– The average of the NFBC auction values of the given season. This in effect is what it would have cost to roster a player that year. 2019 data encompasses auctions from the first three weeks of March, whether online or live. 2018 data contains online auctions only from the months of February and March.

- Value– The final full season returned value in an NFBC contest. Using my personal Z-Score based auction calculator, this will give us what each player was worth to roster all season long.

- % of Value – This represents the percent of original cost that the player held. It is the Value divided by the AAV.

Note: The 2018-2019 full season values have been capped at a full season value of -$5 per player. Players with negative values are below replacement and are not worth rostering. These players should effectively be cut from rosters before returning massively negative values. For this study, we will let players earn a slight negative value (-$5), but not more.

Next, we define player value tiers and the classification of season-long results:

Player Group – We will classify player results into four different player groups based on price points:

- Elite – The cream of the backstops. These are players purchased for a minimum of $20. There will be some 2-4 such players each season.

- Upper – The upper, but not elite class of catchers. These are the players purchased for $10-$19 at auctions.

- Middle – These are the mid-level catchers purchased anywhere from $3 to $10 at auctions.

- Endgame – These are the $1 and $2 catchers.

Verdict – We will classify player results into four categories:

- Gain – Profitable players. Players who returned more value than their initial price point.

- Par – Players who roughly earned what was paid for them. (75-100%)

- Most – Players who returned 50% to 75% of their original price.

- Bust – Players who returned less than half of their value, or even negative value.

By multiplication, we can see that there are 16 possible combinations of player groups & verdicts.

Finally, the most important reminder – we are only talking about two-catcher leagues in this analysis. NFBC leagues are of the two-catcher variety.

Overall Observations

| Group | Number of Players | AAV | Value | % of AAV |

|---|---|---|---|---|

| Elite | 5 | 122.1 | 75.3 | 62% |

| Upper | 9 | 106.6 | 132.1 | 124% |

| Mid | 23 | 107.9 | 80.7 | 75% |

| End | 36 | 45.3 | 76.6 | 169% |

| Total | 73 | 381.8 | 364.7 | 96% |

On average, catchers who were drafted in 2018 retained 94% of their initial value. Catchers in 2019 retained 97% of their initial value. A 96% of initial value over the past two seasons is about as high a ratio for players drafted at a certain position as you will ever see.

As mentioned above – the values used in this analysis institute a -$5 cap. To give you a feeling as to the effect of the cap – on an uncapped basis, the % of value ratios are 88% and 92% respectively for the 2018 and 2019 seasons.

Contrasting catchers to another very key position, we have previously seen that starting pitchers only hold about 40% of their initial drafted value.

Profitability

Let’s now take a look the profitability of rostering an elite backstop:

| Name | Year | AAV | Value | % of Value | Verdict |

|---|---|---|---|---|---|

| Gary Sanchez | 2018 | 31 | 9 | 27% | Bust |

| Willson Contreras | 2018 | 23 | 11 | 49% | Bust |

| Buster Posey | 2018 | 21 | 10 | 50% | Most |

| Jacob Realmuto | 2019 | 25 | 28 | 111% | Gain |

| Gary Sanchez | 2019 | 22 | 18 | 80% | Par |

| Total | 122 | 75 | 62% | ||

| Average | 24 | 15 | 62% |

On average, the elite catchers have held most of its value. In 2018, two of the three elite options were busts, while the third barely earned half of his value. 2019 was a different story. The top options either held the vast majority of their worth or turned a profit.

Some of the 2018 lost value came from injuries as Gary Sanchez only played 89 games. Contreras did play in 138 games, so his value drain was either from poor play – or perhaps from nagging injuries. Between 2017 and 2019, his HR totals jostled from 21 to 10 to 24.

With only 5 catchers over two seasons in this elite band, we may have a sample size issue. Let’s take a look at the upper tier of catchers next.

| Name | Year | AAV | Value | % of Value | Verdict |

|---|---|---|---|---|---|

| Jacob Realmuto | 2018 | 16 | 25 | 159% | Gain |

| Salvador Perez | 2018 | 14 | 19 | 138% | Gain |

| Mike Zunino | 2018 | 11 | 6 | 54% | Most |

| Evan Gattis | 2018 | 10 | 17 | 167% | Gain |

| Yasmani Grandal | 2019 | 14 | 21 | 147% | Gain |

| Willson Contreras | 2019 | 12 | 16 | 134% | Gain |

| Wilson Ramos | 2019 | 10 | 15 | 153% | Gain |

| Yadier Molina | 2019 | 10 | 10 | 104% | Gain |

| Buster Posey | 2019 | 10 | 3 | 27% | Bust |

| Total | 107 | 132 | 124% | ||

| Average | 12 | 15 | 124% |

Wow! That is one heck of a profitable list of catchers. On average, the field returned a 24% profit on top of their initial investment. That is enormous!

Every single catcher with the exception of Buster Posey held onto the majority of their value for the duration of the season. Is almost appears as if Posey, who resides at the very bottom end of the tier, should not even belong inside of it. Ignoring the SF veteran, Mike Zunino was the only other catcher who didn’t make a profit on the initial investment; all other catchers returned a % of value surpassing 100%.

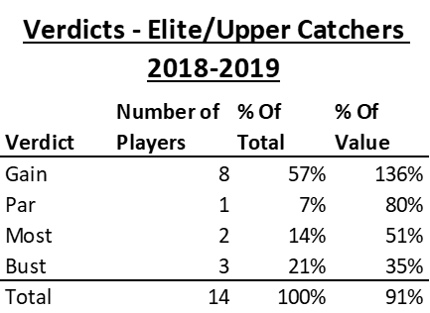

Combining the Elite and Upper tiers – almost two-thirds of all $10+ catchers returned 80% of their value or more. On the whole, elite/upper tiered catchers recouped over 90% of their initial investment – which is a remarkable number.

Onto the mid-tiered catchers:

| Name | Year | AAV | Value | % of Value | Verdict |

|---|---|---|---|---|---|

| Wilson Ramos | 2018 | 10 | 18 | 186% | Gain |

| Yadier Molina | 2018 | 10 | 20 | 211% | Gain |

| Welington Castillo | 2018 | 8 | -1 | -14% | Bust |

| Austin Barnes | 2018 | 7 | -1 | -20% | Bust |

| Jonathan Lucroy | 2018 | 6 | 5 | 79% | Par |

| Brian McCann | 2018 | 5 | -1 | -26% | Bust |

| Jorge Alfaro | 2018 | 5 | 7 | 160% | Gain |

| Yasmani Grandal | 2018 | 4 | 19 | 480% | Gain |

| Austin Hedges | 2018 | 4 | 6 | 142% | Gain |

| Robinson Chirinos | 2018 | 3 | 13 | 405% | Gain |

| Travis D’Arnaud | 2018 | 3 | -5 | -157% | Bust |

| Chris Iannetta | 2018 | 3 | 4 | 127% | Gain |

| Danny Jansen | 2019 | 6 | 1 | 17% | Bust |

| Mike Zunino | 2019 | 4 | -5 | -125% | Bust |

| Robinson Chirinos | 2019 | 4 | 10 | 242% | Gain |

| Welington Castillo | 2019 | 4 | -1 | -20% | Bust |

| Yan Gomes | 2019 | 4 | 2 | 62% | Most |

| Francisco Cervelli | 2019 | 3 | -5 | -167% | Bust |

| Tucker Barnhart | 2019 | 3 | 1 | 46% | Bust |

| Isiah Kiner-Falefa | 2019 | 3 | -4 | -125% | Bust |

| Austin Barnes | 2019 | 3 | -3 | -103% | Bust |

| Martin Maldonado | 2019 | 3 | 0 | -8% | Bust |

| Francisco Mejia | 2019 | 3 | 0 | -3% | Bust |

| Total | 108 | 81 | 75% | ||

| Average | 5 | 4 | 75% |

On average, this cohort retained 75% of its initial value. While still an excellent figure, it pales in comparison to the 124% of the upper tier. This 75% ratio is actually worse if you consider uncapped values. If the likes of Cervelli in ’19 or D’Arnaud in ’18 are uncapped, the ratio falls to around 70%.

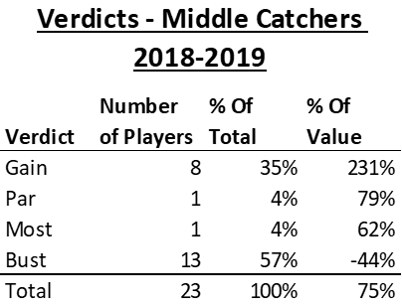

Looking at the hit & bust rates for middle catchers:

About two-fifths of the players held onto or made a profit. Those eight players who gained – did so by finishing with more than double the price that they were purchased for. This is definitely the gamble section. Most of the time the players completely flop, but if not – they are well worth drafting.

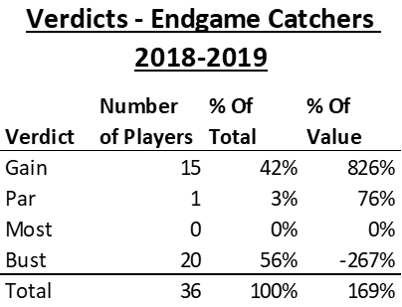

For the endgame catchers – rather than list them all out individually (it is a long 36 player list), here are the verdicts for the final group of backstops:

A 169% average return! Even on an uncapped basis, the average % of value is ~130%, which makes this catcher group very profitable. As with any endgame group – the large ROI typically is attributable from the low investment, rather than from a high return. But here, both the frequencies and severities were enormous positives for endgame catchers. Over two-fifths of this group were profitable, and those that were had an 826% percent of value ratio.

What isn’t even included, is the fact that the busts in the endgame group could be dropped and replaced from the waiver wire! This analysis makes the assumption that all players are held for the entirety of the season (albeit subject to a -$5 minimum value). Of course, instead of holding unprofitable players all season – one option that fantasy owners should employ to increase their team’s value is to stream catchers. I’ll have more about streaming catchers in a later article – but especially for the 2019 season, streaming catchers was auspicious. Streaming is nicely facilitated by drafting $1-2 catchers.

The $3 Auction Effect

Here is one aside that I found interesting. Take a look at the composition of the middle-tiered catchers. It almost seems as if the endpoint (which of course is artificial) should have been chosen to end on the $4 catchers, instead of at $3. For the $4+ catchers in this group, the % of Value ratio is ~100%. The $3 catcher ratio was ~0%.

I chose the tier endpoints for this exercise to ensure that there would be a strictly increasing number of players in each group, as we move downwards towards the lower levels. Intuitively, we shouldn’t expect there to be a large difference between $3 players and $4 players – but we can observe here that $4+ middle catchers were nicely profitable, while $3 catchers were all busts.

My conjecture is that $3 catchers may truly be $2 or $1 catchers. Due to auction dynamics, owners afforded the extra $1 or $2 to acquire these players, making them appear to have a $3 AAV. Perhaps owners had too much money in the end, were pigeonholed, or had an affinity for the 20th best catcher vs the 25th best catcher, etc. My point is that the $3 price point may actually not be a true market indication.

This is what we will call the $3 Auction Effect. It is the effect of the $3 AAV players which are in truth $1-2 players, but appear as $3 solely due to auction dynamics. This effect clearly applies to catchers as above, however, the principle should also be applicable to other positions.

Conclusion

With regards to two-catcher formats, the most accretive catcher investments can either be found towards the top of the draft board, or at the very bottom. In particular – it is the $11 to $20 catchers that have historically had the best hit rates and the best returns on investment.

Now, of course, simply because 2018 and 2019 worked out that way, it does not guarantee success in 2020. It certainly does not ensure that the very catcher you will purchase within these range will succeed. But going by experience, you have an excellent chance at returning a profit by selecting a catcher in this range.

If one does not want to spend for the $11-20 tier, he/she is best advised to spend as little as possible. Owners might be best spending just $1-2 at the auction, in favor of streaming catchers during the season. For a mere $1-2 offering, historically, almost half of the players turned a profit – and an enormous one at that.

Stars or Scrubs? The answer is a 1A catcher, or a scrub. Perhaps try one of each in your 2020 drafts.

Ariel is the 2019 FSWA Baseball Writer of the Year. Ariel is also the winner of the 2020 FSWA Baseball Article of the Year award. He is the creator of the ATC (Average Total Cost) Projection System. Ariel was ranked by FantasyPros as the #1 fantasy baseball expert in 2019. His ATC Projections were ranked as the #1 most accurate projection system over the past three years (2019-2021). Ariel also writes for CBS Sports, SportsLine, RotoBaller, and is the host of the Beat the Shift Podcast (@Beat_Shift_Pod). Ariel is a member of the inaugural Tout Wars Draft & Hold league, a member of the inaugural Mixed LABR Auction league and plays high stakes contests in the NFBC. Ariel is the 2020 Tout Wars Head to Head League Champion. Ariel Cohen is a fellow of the Casualty Actuarial Society (CAS) and the Society of Actuaries (SOA). He is a Vice President of Risk Management for a large international insurance and reinsurance company. Follow Ariel on Twitter at @ATCNY.

How do people like Will Smith or Sean Murphy fit in here?

Smith is the catcher to own this year, at a reasonable price too.

Smith comes close.